It is symbolic that on World Milk Day, 1 June, the second session of expert talks on the topic “Export Logistics of Ukrainian Dairy Products” to support and promote dairy export during the war was held.

The event participants were able to join the discussion of the logistical issues with the key speakers, namely:

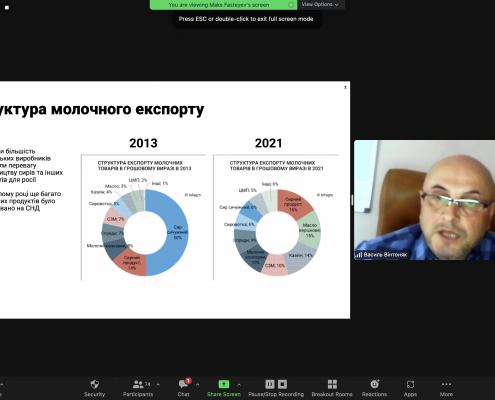

Vasyl Vintoniak, Director of INFAGRO Analytical Agency;

Yurii Vaskov, Deputy Minister of Infrastructure of Ukraine;

Valerii Tkachov, Deputy Director of Commercial Affairs Department of Ukrzaliznytsia JSC (Ukrainian Railway);

Mykhailo Sokolov, Advisor to the Minister of Agrarian Policy and Food of Ukraine;

Yurii Schevchuk, Business Development Director, Olam Food Ingredients Ukraine.

Thus, during the expert talks the dairy export development trend and geography, problems and established mechanisms of Ukrainian dairy export logistics, as well as exporters’ and traders’ expectations from the government were presented.

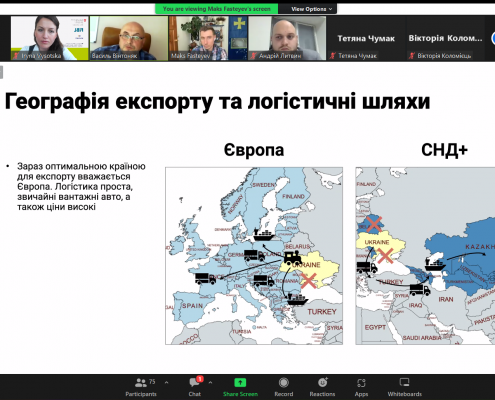

According to Vasyl Vintoniak, the war of russia against Ukraine did not start on 24 February 2022, but back in 2014. Even before the military aggression, there had been “cheese” trade wars. However, in 2013, the biggest share of Ukrainian cheese export was to russia. Since 2014, after the trade relations with russia were broken and a surplus of milk was formed, butter, dry fat-free milk, and casein became the priority product categories for export. Now the European countries are the most important for dairy export because logistics is arranged mainly with regular trucks. Sales to such Asian countries as Kazakhstan, Uzbekistan, Turkmenistan, Georgia, and Azerbaijan will be reduced due to complicated and expensive logistics.

Yurii Vaskov added that since the beginning of the russian large-scale invasion of Ukraine export and import routes changed completely. The Ministry of Infrastructure of Ukraine offers three export channels:

- The Danube river ports (in Izmail, Reni, Kilia);

- Borders with 5 countries (Romania, Moldova, Slovakia, Hungary, Poland);

- Railway and road transportation.

As of May 2022, new logistical routes allow exporting only 20-25% of the total export volume from Ukraine.

In his speech, Valerii Tkachov focused on railway transportation by Ukrzaliznytsia JSC to 13 border crossing points for further export, but not to sea ports as it was before the full-scale invasion. As of today, Ukrzaliznytsia does not use its full potential due to the following reasons:

- Technical: due to the difference in the railway width in the EU and Ukraine the goods are transhipped into the European carriages. As a result, the unloading capacity on the borders is insufficient. It should also be admitted that the shortage of carriages in the partner countries is a significant limitation.

- Bureaucratic/organizational: there is border and customs checks both in Ukraine and the EU countries.

According to the statistics, small amounts of dairy products were transported by Ukrzaliznytsia. For example, only 49 carriages delivered dairy products in 2021, and in 2022 only 3 carriages have been used for this purpose.

Mykhailo Sokolov supported his colleagues and noted that Ukraine is trying to export the volume which exceeds the crossing capacity. In order to export at least some goods faster, we have to prioritise them. These are higher added value and expensive goods, which can be profitable for the Ukrainian economy.

In his turn, Yurii Schevchuk voiced the traders’/exporters’ expectations from the government:

The government has to develop the state guarantee mechanisms or provide state bank loans for the buyers’ accreditation;

To lobby the interests of Ukrainian dairy producers on the key import markets.

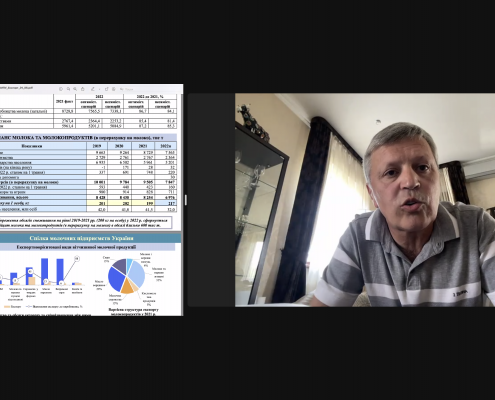

The floor was given to Arsen Didur, Executive Director of the Union of Dairy Enterprises of Ukraine. He noted that the forecast milk production in Ukraine in 2022 is 7.5 million tonnes, 600 thousand tonnes of which can be exported. According to the business union representatives, dry free-fat milk, whey, powdered whole milk, condensed milk, casein, and butter will be the relevant export product categories. The dairy sector may appear beyond the export priority due to the focus on grains to reduce world hunger. How can the government help the dairy sector?

To relieve the export logistics through temporary simplification of market access to the European market for the enterprises that have no European veterinary permits.

To increase domestic sales, the products of critical import have to be analysed.

For all the materials of the second expert discussion, including speakers’ presentations and analytical bulletin see here.

You are also welcome to join the next expert discussion on the topic “Opportunities for Ukrainian Exporters on the EU and Global Markets” which will be held on 15 June. Follow the event announcements on the websites of INFAGRO and State Enterprise “Export and Entrepreneurship Promotion Office”.

__________________

This event was organized together with the State Enterprise “Export and Entrepreneurship Promotion Office” and analytical agency INFAGRO with the support of Switzerland in the frame of the Swiss-Ukrainian Program “Higher Value Added Trade from the Organic and Dairy Sector in Ukraine” implemented by the Research Institute of Organic Agriculture (FiBL, Switzerland) in partnership with SAFOSO AG (Switzerland) www.qftp.org.